Merger will form one of the premier water midstream companies in the United States HOUSTON, Sept. 16, 2022 /PRNewswire/ -- Pilot Water Solutions LLC ("PWS") and Oilfield Water Logistics ("OWL") are pleased to announce a new partnership, merging the two businesses to create the premier water midstream operator in the Northern Delaware Basin. The significantly scaled water...

permian

Vacuum Truck Offloading Lanes w/ Covered Canopy at a Commercial Saltwater Disposal Well in Oklahoma OKLAHOMA CITY, Dec. 5, 2022 /PRNewswire/ -- Bison Water Midstream, Oklahoma's largest water infrastructure and logistics provider, today announced it has acquired all of the Oklahoma assets owned by Lagoon Water Midstream as well as the water infrastructure owned by Overflow...

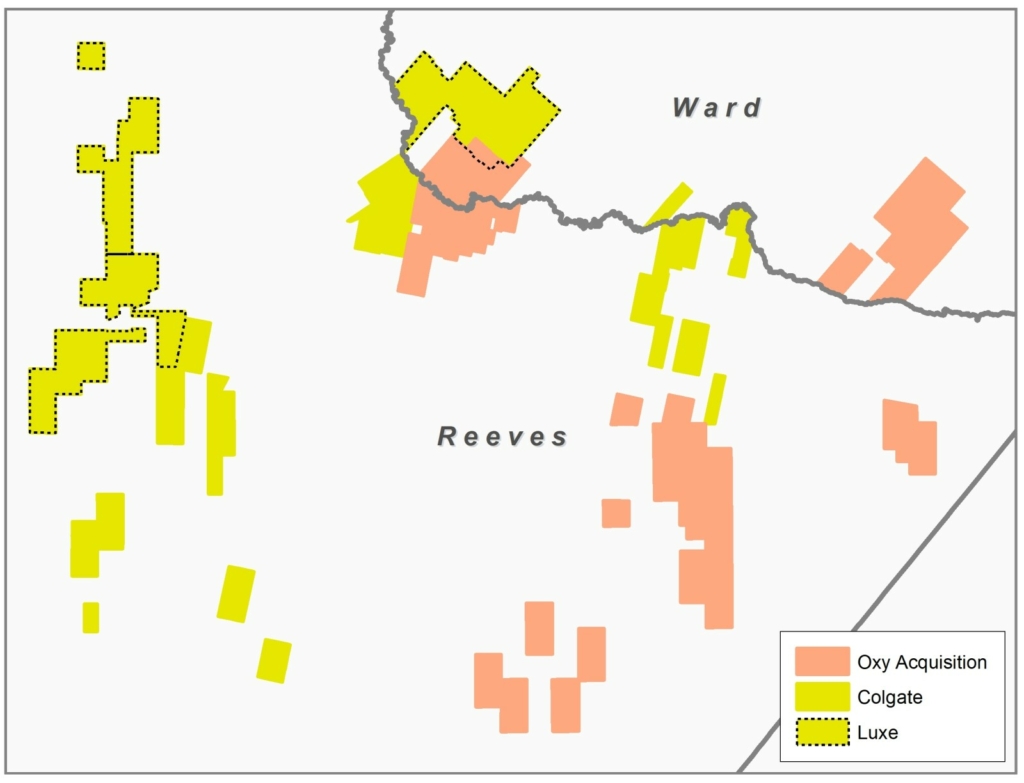

September 10, 2021 Houston, TX /PRNewswire/ - WaterBridge Holdings LLC (together with its subsidiaries, "WaterBridge") announced today that it has closed a transaction with Colgate Energy, LLC ("Colgate") to acquire the produced water infrastructure associated with Colgate's recent asset acquisition from Occidental. In connection with the acquisition, WaterBridge and Colgate have entered into a new...

Lagoon becomes a multibasin player in water management while WES locks down assets that could drive future deals. A pair of active water management players have completed separate deals to expand their individual offerings in the Permian Basin of west Texas. Lagoon Water Midstream has closed a deal to acquire Double Drop Resources, a water management company located in the Midland Basin. Financial...

The pureplay water midstream company bought the produced water infrastructure associated with Colgate’s purchase of Occidental acreage in June. This map shows the acreage Colgate acquired from Occidental in June. WaterBridge has purchased the associated produced water infrastructure from Colgate. Expanding its holdings further in the Delaware Basin, WaterBridge Holdings closed a transaction with...

The last growing market of US land services, water disposal, is set for an all-time high in the Permian. Water disposal in the Permian Basin is likely to hit a new all-time high in the fourth quarter of 2020, exceeding 1.3 billion bbl for the period for the first time in history, potentially further expanding Texas’ total water market which had already recovered close to its pre-COVID record in...

Pilot Water Solutions has expanded its position as a major disposal player in the Delaware Basin of west Texas with its acquisition of Felix Water. Financial terms of the deal were not disclosed. Pilot Water is a majority-owned subsidiary of Pilot Company, a supplier of gasoline and the largest operator of travel centers in North America. The addition of the Felix assets will bring Pilot Water’s...

Oil and gas wastewater operations in the Permian Basin continued to grow alongside and upswing in production as the nation and world recovered from COVID-19. The health crisis brought on an historical collapse in demand for fossil fuels, meaning production of crude oil and natural declined. But as the market recovered, so did production and the installation and expansion of produced water facilities...

After a brutal 2020, the oil and gas industry outlook is positive and increasing activity levels are increasing demand for water management services and solutions. IHS Markit estimates the U.S. oilfield water management to be valued at around $37 billion in 2019, representing a 12% year-on-year (y/y) market growth from 2018; this is mainly driven by water disposal and water logistics. The Permian...

Oilfield water midstream companies are the fastest-growing segment of the oil and gas sector today. An industry that is projected to grow significantly over the next few years. IHS Markit, Woods Mackenzie, Rystad Energy and Raymond James all predict big growth for produced water management. And with that growth, we’ve already seen big investments in the water midstream sector. We’ve seen Goodnight...